Who is Fred Haney?

Over 50 years of experience, 60 startups built and 16 successful exits

Dr. Fred Haney is the founder and President of the Venture Management Co., a firm that provides assistance to high tech companies. He is the author of “The Fundable Startup: How Disruptive Companies Attract Capital,” published on February 6, 2018, by Select Books of New York.

Other accomplishments include:

Founder and manager of 3i Ventures, California, a venture capital fund that invested $80 million and produced 19 public companies and top quartile returns. Founder, Monday Club, a 1400-member mentoring network (MondayClub.com). Co-founder, Tech Coast Angels, one of the largest angel investor groups in the U.S.

Dr. Haney has been a co-founder of five startup companies, including NovaDigm Therapeutics, the first fungal vaccine tested in humans, DRC Computer, the most powerful gene sequencing computer in the world, and NMR Finder an artificial intelligence nuclear magnetic resonance imaging accelerator. He was a director of Orange County’s Parcel Pending, a leading supplier of kiosk-based locker systems for package delivery. He has been a director of over 30 high-tech companies.

In 1999, he was selected “Mentor/Angel of the Year” by the American Electronics Association in Orange County. In 2002, he was named “Director of the Year for Early Stage Companies” by the Forum for Corporate Directors. Before 1983, Haney held senior management positions with Xerox, CSC, and TRW. He holds a Ph.D. in Computer Sciences from Carnegie-Mellon University, an M.S. in Mathematics from Colorado State University, and a B.A. from Ohio Wesleyan University.

Some reasons that I am good at advising startup companies:

- I have been the CEO of five companies; that experience is invaluable

- My corporate planning and VC work taught me how to “facilitate” conversations within an organization—as opposed to “dictating” outcomes

- Having dealt with 100s of companies and served on over 30 boards, I have seen just about everything. I rarely see a situation I haven’t encountered before.

- My strong mathematics and technical background enable me to understand just about any technology—at least to the level required to build a business

- One of the most critical determiners of startup success is the company’s ability to clearly articulate it’s plans and goals. I have spent a lifetime writing about complex subjects and have helped many companies achieve breakthroughs in their ability to send clear messages.

Fred’s other book:

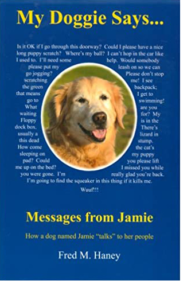

My Doggie Says… is about a golden retriever named Jamie and her ability to communicate with her people, Fred and Barbara. Through different actions and body language, she sends messages. The book contains 85 full color photographs to illustrate some of Jamie’s special communications. The reader learns how to become a better pet “listener” and how to create a more nurturing relationship with a pet.

My Doggie Says… is about a golden retriever named Jamie and her ability to communicate with her people, Fred and Barbara. Through different actions and body language, she sends messages. The book contains 85 full color photographs to illustrate some of Jamie’s special communications. The reader learns how to become a better pet “listener” and how to create a more nurturing relationship with a pet.

Eight Things You May Not Know About Me

I love golden retrievers

I Wrote a book about my dog. “My Doggie Says: Messages from Jamie.

I had a radio show

I Hosted the “My Doggie Says…” radio talk show for 4 years on KFNX radio in Phoenix.

I fish

I also love golf

I Love photography

I Love writing

I played Basketball

I'm efficient

I can usually create a complete strategic plan for a startup in 4-6 hours. To be effective as a venture capitalist, you have to be very good at multi-tasking and making the most effective possible use of your time.